The United States of America 🇺🇸 with a GDP of $25.44 trillion is the most wealthy nation in human history. There’s no shortage of wealth or opportunities in its economic ecosystem. In addition to being #1 in GDP, it’s home to the most millionaires (24,480) and billionaires (724). Despite these strengths and advantages there are statistics that add to a greater picture.

☠️ According to Barrons 65% of Americans live paycheck to paycheck.

☠️ As of February 5th 2024, student debt is at $1.74 trillion.

☠️ Credit card debt in the US is at $1.13 trillion.

☠️ The infamous national debt is at $34.37 trillion and it’s only getting higher.

When analyzing these numbers my takeaway is that generating wealth isn’t a problem, it’s being responsible with it.

Jiddu Kirshnamurti when looking at the current health standards around the world said,“It is no measure of health to be well adjusted to a profoundly sick society.” 🤒 This same idea can be applied to the sickness for how people are managing money. It’s worth acknowledging that everybody’s situation is different with unique circumstances and different hurdles. My purpose with writing this isn’t to judge, it’s to foster optimism.

Scenarios out of our control could be needed medical expenses, accidents, and taking on more debt for school in order to get into a career. While these influences can hobble a person, there are more factors that are in everybody’s control. These range from gaining more knowledge about personal finance, being more disciplined with a budget, creating a plan, or meeting with a financial expert. Empowerment comes by assuming control of one’s finances and taking on more responsibilities to be better. Anyone can become a success story.

To quote the late Uncle Ben from Spiderman,“With great power comes great responsibility.” In the context of personal finance, you can flip this around to say, “With great responsibility, comes great power.”

Any amount of wealth managed requires great responsibility. And the first step to becoming more responsible is learning to become a money magnet 🧲💰.

Disclaimer, I’m not a millionaire 🚨. I can say my wife and I are debt free, we live comfortably, and we do not live paycheck to paycheck. In the past we have been hit with student loans, medical emergencies and big car repairs. We attribute our good standing on common sense and best practices that we’ve learned from becoming educated. Growing up I was privileged to have a Mom and Grandma that gave me a sense of urgency to be smart with money. My Grandma would take the opportunity to teach about money after paying me to clean her house and mow her lawn. She always emphasized the importance of paying 10% of my income to the church, setting money aside for school, and having an emergency fund. Pretty basic and easy enough to understand for a teenager. My Mom on the other hand gave me a tough lesson which has always stuck with me. She emphasized the importance of financial independence and let me know she won’t be coming to save me with money. Not that she didn’t love me, I knew that. The reality was she couldn’t, and being a single mother she couldn’t neglect preparing for her own future. This might sound tough but knowing “the calvary is not coming into save you,” has put me in a place where I have needed to be realistic, strategic, and in control. As a gift when I was in high school my Mom paid for me to take Dave Ramsey’s Financial Peace University courses. Twice. And this was in the 2000s so we watched these webinars at a local Presbyterian church one night a week for 6 weeks.

I’m grateful to my Mom and Grandma for those lessons. They taught me about reality and the importance of learning all you can about personal finance. And as a product of that I’ve created Make it Green March ☘️.

For context, during the year I have designated months where I’ll focus on developing a skill or attribute. For example, I have Sober October which was inspired by Joe Rogan. This is my own version of lent. For for 30 days I’ll abstain from going on social media or late nights so I can make sure I get 8 hours of sleep. In November I’ve tried different challenges. One is NOvember inspired by Gary V, meaning I try and find ways to simplify my life by saying No 👎. The other is pretty cliche and that’s celebrating gratitude 🦃. To celebrate gratitude I’ll message people who have impacted my life in a positive way and thank them. I’d also write a list of things I’m grateful for every morning/night but this habit has stuck so that every day when I write in my journal I’ll close with a list of things I’m grateful for in that moment.

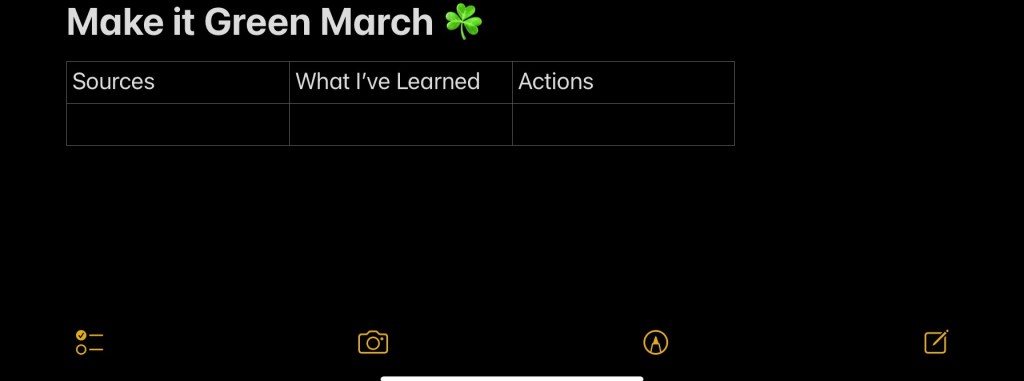

My challenge for the month of March is one of the most important influences in the art of living, and that’s personal finance. Make it Green March ☘️ is when I learn and do all that I can to improve my skills and situation around money. Prior to March 1st I’ll order books, find podcasts, schedule a meeting with a financial advisor, and prepare a section in my Notes app that looks something like this.

As a result of Make it Green March ☘️ I’ve benefitted by:

💪 Improving our family’s money management strategies. For example changing how we budget and knowing at all times where we stand financially.

🗓️ Creating new new habits. Such as religiously reviewing finances on a weekly basis.

🧠 Become more knowledgeable about best practices with personal finance.

🧮 Writing and tracking inspiring financial goals with actions we’re taking to make those a reality.

I’m optimistic that one day Make it Green March ☘️ will become an international celebration and movement. I can imagine it now, Human Resource departments across the world will make their employees sit in seminars learning about personal finance and celebrating the peace of mind it brings. There will be billboards, influencers, and local businesses promoting it.

On a serious note, when it comes to maximizing return from efforts made, personal finance ranks high on that list. I’ll be working on this challenge throughout the month and my posts will be focused on Make it Green March ☘️. Enjoy the list I’ve compiled of resources that have made me more money, helped me become debt free, and financially intelligent. If you’re answering the call to celebrate, tag me on Social Media @realjakebardsley or use the hashtag #makeitgreenmarch ☘️ .

Books

Psychology of Money

Rich Dad Poor Dad

The Richest Man in Babylon

Your Money or Your Life

Rich AF

I Will Teach You to Be Rich

The Little Common Sense Book of Investing

The Millionaire Next Door

Total Money Makeover

Podcasts

The Ramsey Show

I Will Teach You to Be Rich

BiggerPockets Money

The Clark Howard Podcast

Networth and Chill with Your Rich BFF

Personal Finance Influencers

Your.richbff

Dave Ramsey

Calltoleap

Suze Orman

Ramit Sethi

For book recommendations, gems I’ve found while reading, and book summaries follow the social media account below.

Again, I can’t express how much I appreciate your time and attention 🙏.